The Best Guide To Feie Calculator

Table of ContentsSome Known Questions About Feie Calculator.Not known Details About Feie Calculator What Does Feie Calculator Mean?Feie Calculator for BeginnersNot known Facts About Feie Calculator

He sold his United state home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his wife to aid fulfill the Bona Fide Residency Examination. In addition, Neil secured a long-term building lease in Mexico, with plans to eventually purchase a building. "I presently have a six-month lease on a house in Mexico that I can prolong one more 6 months, with the intention to purchase a home down there." However, Neil mentions that purchasing building abroad can be challenging without very first experiencing the place."It's something that individuals require to be actually persistent concerning," he states, and encourages deportees to be cautious of usual blunders, such as overstaying in the U.S.

Neil is careful to stress to Stress and anxiety tax united state tax obligation "I'm not conducting any carrying out in Service. The U.S. is one of the couple of nations that tax obligations its residents no matter of where they live, indicating that even if a deportee has no income from U.S.

tax returnTax obligation "The Foreign Tax obligation Credit rating enables individuals functioning in high-tax countries like the UK to counter their U.S. tax responsibility by the quantity they've currently paid in taxes abroad," says Lewis.

Feie Calculator Things To Know Before You Buy

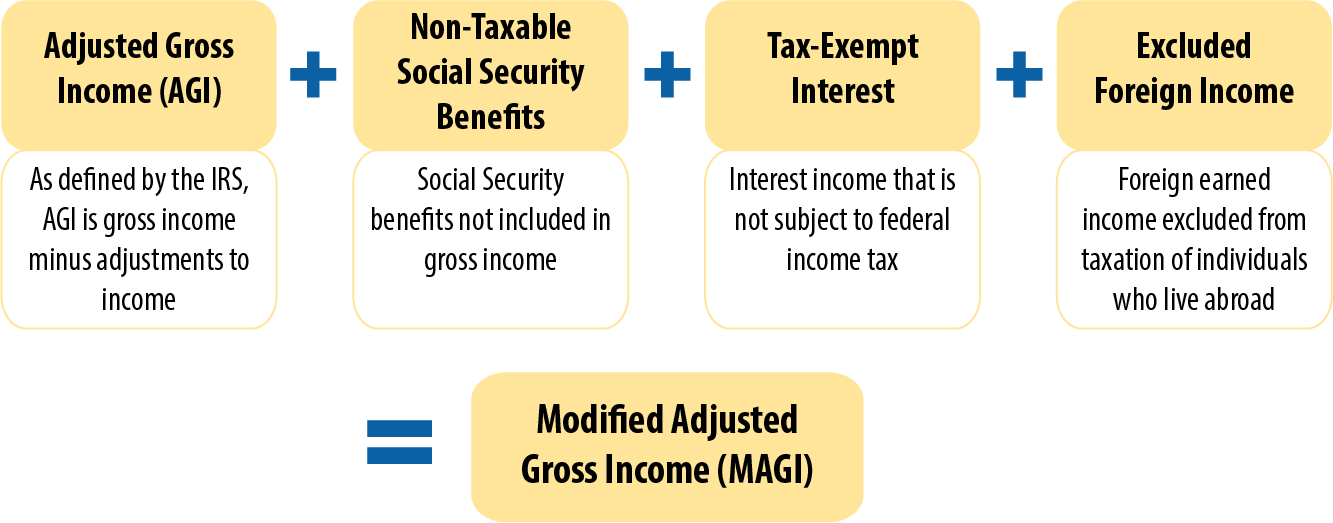

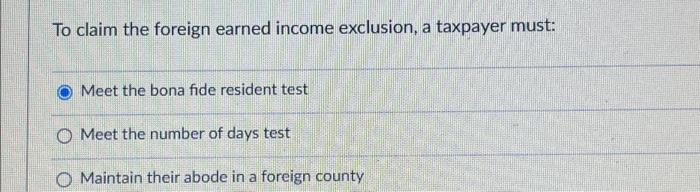

Below are a few of one of the most regularly asked questions about the FEIE and other exemptions The International Earned Income Exclusion (FEIE) enables U.S. taxpayers to omit as much as $130,000 of foreign-earned income from federal earnings tax, lowering their united state tax obligation responsibility. To get approved for FEIE, you must fulfill either the Physical Existence Examination (330 days abroad) or the Bona Fide House Examination (confirm your key house in an international nation for a whole tax year).

The Physical Presence Examination also calls for U.S (Foreign Earned Income Exclusion). taxpayers to have both a foreign revenue and an international tax obligation home.

Excitement About Feie Calculator

A revenue tax obligation treaty between the united state and another nation can discover here help protect against dual taxation. While the Foreign Earned Revenue Exclusion minimizes gross income, a treaty may supply additional advantages for qualified taxpayers abroad. FBAR (Foreign Financial Institution Account Report) is a called for declare united state people with over $10,000 in foreign economic accounts.

Eligibility for FEIE depends on meeting specific residency or physical visibility tests. He has over thirty years of experience and currently specializes in CFO solutions, equity payment, copyright taxation, marijuana tax and divorce associated tax/financial planning issues. He is an expat based in Mexico.

The international gained revenue exclusions, sometimes referred to as the Sec. 911 exclusions, leave out tax on earnings made from functioning abroad.

7 Easy Facts About Feie Calculator Explained

The tax benefit excludes the income from tax obligation at lower tax obligation prices. Previously, the exclusions "came off the top" minimizing earnings topic to tax obligation at the leading tax rates.

These exemptions do not spare the incomes from US tax but merely give a tax obligation reduction. Note that a bachelor functioning abroad for every one of 2025 who earned concerning $145,000 without other income will have gross income reduced to absolutely no - successfully the same solution as being "free of tax." The exemptions are calculated each day.